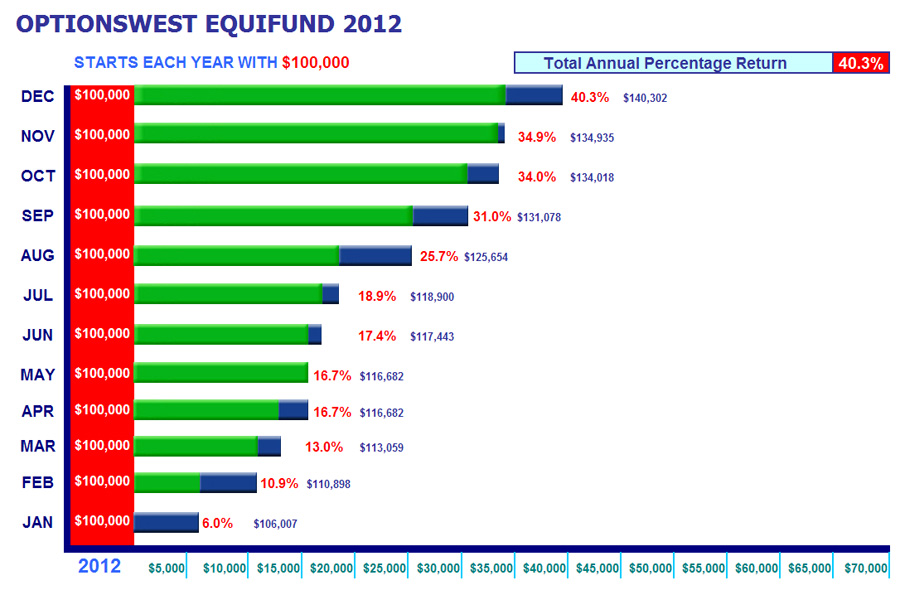

Take a look at the detailed results of our conservative Education Fund.

Many folks are quite skeptical of these numbers, and this is understandable given how the press portray stock market investing these days. Of course, journalists are not successful investors and really know very little about it, so let's stop listening to them. Also, given the low rates of return offered by bank CD's and Mutual Funds today, people are accustomed to expect meager percentage returns.

Our Starter Class is free, you will not be pressured into buying anything and we promise you will learn more than you can imagine about investing. We have opened the eyes of many skeptical folks to the wonders of actually knowing how to succeed in the market. Give us the opportunity to open your eyes.

Individuals who trade near-term straight options are "Options Speculators", who count on very risky concepts in investing their funds. They rely on guesswork, rumor, gossip, wishes, hopes, assumptions and the like. This is not a very sound basis for the conservative investor. We do not recommend or practice straight short term options trades. They are just too risky and not required to create a healthy growing investment account.

OptionsWest uses a very disciplined and conservative approach and would never recommend trading risky near-term options. The "Options" in OptionsWest is very conservative. Many of the approaches we teach are so conservative the IRS allows them in IRA accounts. We promise to show you the possibilities that are open to those who actually know what they are doing when investing in equities. Our approach is not a big secret or some new brilliant get rich scheme, it is a hybrid of the strategy professionals use to assure their funds are put to work with sound risk management. Good risk management can be achieved with stops or with a conservative hedged trade. A correctly designed covered calls strategy meets these requirements well. Every successful investor knows how to trade covered calls and how to trade options. They know selling covered calls for income is simple and easy if sound covered calls investment rules are followed. For those who invest in covered calls, trading can be money in the bank. So?... learn covered calls, specifically the unique OptionsWest style covered calls strategies. Learn how to earn money with covered calls. Learn how to sell covered calls. OptionsWest is very much a covered calls school where successfully trading covered calls is our bread and butter.

Click the 2011 Trade detail button below to see a listing of closed out trades from our 2011 Education Fund. It shows the returns achievable with this trading strategy. The returns shown are "cashed out returns" after commission, not paper profits. They represent money in the bank that is available for withdrawl or re-investment. At OptionsWest we do not consider a trade in our rate-of-return computations until we have cashed out of that position. The Starter Class will teach you how these returns were achieved.

|